Building a CO2 infrastructure

Carbon capture projects are well under way but for them to be viable the captured carbon needs to be either permanently locked away or put to good use in industrial processes

Carbon capture is increasingly being seen as a realistic option for overall decarbonisation, either by directly treating emissions or by capturing CO2 from the atmosphere with aim of selling offsets to CO2 emitters.

In the shipping industry the emphasis so far has been on onboard carbon capture (OCC) with numerous projects reported by World Bunkering over the past couple of years.

The IMO’s renewed decarbonisation strategy does not explicitly include offsetting but neither does it rule it out. So, a recent move by a major global commodities market player, and bunker supplier, into offsetting is significant.

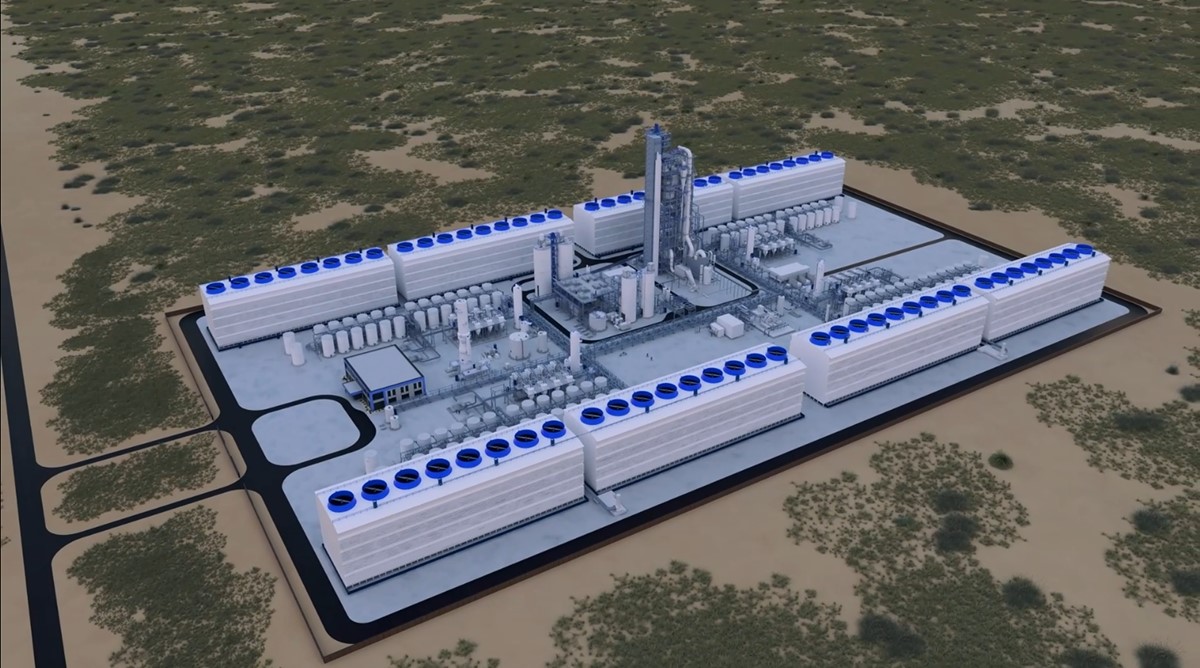

Trafigura has agreed to purchase carbon dioxide removal (CDR) credits to be produced by carbon capture, utilisation and sequestration (CCUS) company1PointFive at its first industrial-scale Direct Air Capture (DAC) facility, STRATOS, which is currently under construction in Texas.

Trafigura says that the deal is its “first transaction towards meeting its commitment as a Founding Member of the First Movers Coalition to purchase at least 50,000 tonnes of durable and scalable net carbon dioxide removal credits generated through advanced CDR technologies by 2030”.

The STRATOS plant is designed to capture up to 500,000 tonnes of CO2 annually when fully operational and is expected to be the largest facility of its kind in the world.

Importantly the captured CO2 underlying Trafigura’s removal credits are to be stored through durable subsurface saline sequestration.

Trafigura says: “The advance purchase of DAC credits from 1PointFive aligns with Trafigura’s commitment to support early-stage technologies to enable high-quality carbon removal credits for its customers. It also marks the establishment of a relationship between 1PointFive and Trafigura to advance DAC as a practical, transparent and durable carbon removal solution.”

It adds: “The agreement paves the way for the broader adoption of 1PointFive’s CDR credits to help hard-to-abate industries address their emissions.” Trafigura doesn’t say so, but shipping surely comes into the ‘hard-to-abate” category.

Marine insurer Gard recently published a paper, written by its London-based Senior Executive, Industry Liaison, Neil Henderson on Carbon carriage: Risks and opportunities.

Henderson notes: “Traditionally, CCS has most often been used for the enhanced recovery of oil from depleted reservoirs. More recently, its profile has grown as a necessary solution to decarbonise hard-to-abate industries such as energy, cement and steel production. Shipping can be added to this, as onboard carbon capture is likely to be required as alternative zero emission fuels are unlikely to be available in the necessary quantities and prices to achieve the IMO’s 2050 and interim targets. That captured CO2 will need transporting from the capture site (whether that be an industrial installation or onboard a vessel) to the injection site, where it will be permanently stored in a subterranean or subsea geological formation.”

Henderson says that estimates are that that global CCS capacity must increase 120 times from current levels by 2050, rising to at least 4.2 gigatonnes per annum, for countries to achieve their net-zero commitments. He comments: “Whilst pipelines will generally offer a more cost-efficient option where there is sufficient scale and regularity of supply of CO2, carriage by sea is more appropriate for longer distance transport (over approximately 350km), flexibility of quantity, source and injection locations. Estimates of global offshore storage capacity range from 2,000 to 13,000 gigatonnes of CO2. Regions such as Korea, Japan and the North Sea, which have subsea storage locations and coastal-based emissions, are likely to be suitable for seaborne carriage of CO2. If onboard carbon capture is widely adopted, this will require carriage by sea from temporary port-based to permanent storage locations.”

As noted by Gard, one of the leading CCS schemes is the Norwegian government-sponsored Longship project. This includes capturing CO2 from industrial sources in the Oslo-fjord region (from cement, chemicals and energy) and shipping liquid CO2 from these industrial capture sites to an onshore terminal. From there, the CO2 will be transported by pipeline to an offshore subsea storage location in the North Sea. It has recently signed contracts to receive about 1.2 million tonnes CO2 annually from the Netherlands (Yara Sluiskil) and Denmark (Orsted power stations). Northern Lights is responsible for developing and operating the CO2 transport and storage facilities for the project. Phase one is due to be operational in 2024 with an annual storage capacity of up to 1.5 million tonnes of CO2.

So, it is clear that infrastructure based on the permanent underground storage of CO2 is being put together. However, it is possible that a portion of recovered CO2 could be used in production processes.

A new report, Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players, from IDTechEx predicts that, by 2044, utilisation of waste CO2 will reach 800 tonnes to create over 3,000 tonnes of useful products.

The research and consultancy firm says CO2-derived building materials and CO2-derived fuels represent the areas with high growth potential. It says carbon dioxide utilisation (CO2U) in building materials is the more straightforward technology, able to lower the carbon footprint of ready-mixed concrete, pre-cast concrete, and carbonate aggregates/supplementary cementitious materials through mineralisation reactions. Carbon dioxide can be permanently stored, and cement use can be reduced. Growth, IDTechEx predicts, will be driven by new certifications, superior materials performance, and the ability to achieve price parity through waste disposal fees.

Compared to the gigatonnes of CO2 that are expected to be captured in 20 years’ time, the figures quoted by IDTechEx can appear insignificant. However, it says: “Revenue generated through CO2U over the next two decades will be vital to enabling the development of commercially viable CO2 capture technologies for the future. In combination, carbon capture, utilization, and storage technologies are critical in supporting the decarbonization of the world’s economy as countries strive to reach net zero goals.”

The fleet that will carry captured CO2 to permanent storage sites, or for industrial uses, is beginning to emerge. LR has announced it is to class its first newbuild project for mid-size low pressure ammonia-ready liquid CO2 (LCO2) carriers ordered by Capital Gas Ship Management at Hyundai Mipo Dockyard

LR says the project follows a collaboration between Capital, HMD, and LR, paving the way for further orders of LCO2 carriers, which it describes as “a crucial component to supporting the wider carbon capture and storage value chain”.

Image Credit: 1PointFive

get

in touch

Constructive Media

Constructive Media

Hornbeam Suite

Mamhilad House

Mamhilad Park Estate

Pontypool

NP4 0HZ

Tel: 01495 239 962

Email: ibia@constructivemedia.co.uk

On behalf of:

IBIA London Office

Suite Lu.231

The Light Bulb

1 Filament Walk, Wandsworth

London, SW18 4GQ

United Kingdom

Tel: +44 (0) 20 3397 3850

Fax: +44 (0) 20 3397 3865

Email: ibia@ibia.net

Website: www.ibia.net

Emails

Publisher & Designer: Constructive Media

ibia@constructivemedia.co.uk

Editor: David Hughes

anderimar.news@googlemail.com

Project Manager: Alex Corboude

alex@worldbunkering.net